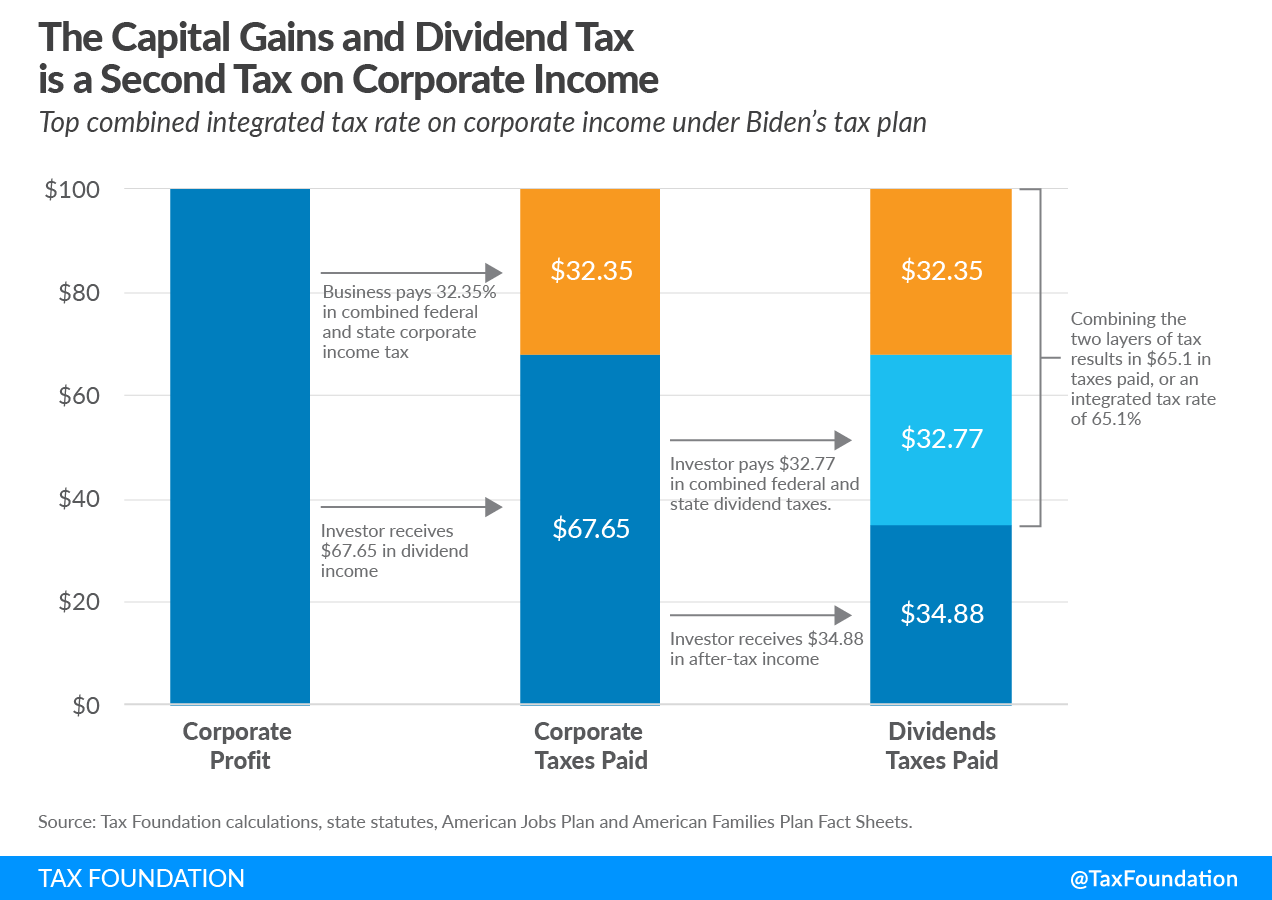

Believe it or not, major tax changes are coming this year. If you are a high income earner, running an owner-only business, President Biden’s new tax proposal could lead you to pay a significant portion of your income in hefty taxes. Fortunately, there is a strategy to counter this. A cash balance defined benefit can help you to create a retirement pension in a tax-efficient way.

Image Source: https://taxfoundation.org/biden-corporate-income/

A Little About the Cash Balance Plan

In a cash balance pension plan, you set a percentage of the participant’s yearly earnings plus set interest credits in separate accounts. It does have similarities to the 401(k) defined-contribution (DC) plans, but cash balance is more of a defined benefits plan. The plan will be funded by you as an employer, and benefit formula for the participants will be pre-defined. These benefits are insured by the Pension Benefit Guaranty Corporation (PBGC). Also, you will bear the investment risks.

While most individuals are comfortable with their 401(k) plans, without a thought about exceeding the annual contribution limit, a cash balance plan will allow you to contribute more into your pension account. This is great for older professionals. In 2021, the limit for pension pay-out is around $230,000 annually, and with this plan someone over 65 can get up to $300,000 annually.

At retirement, you and your employees (if any) will be offered a choice https://taxfoundation.org/biden-corporatebetween a lump-sum pay-out and a monthly payment. The monthly payment will be based on the total service years, individual life expectancy, and the highest 3 consecutive years of income.

However, for a business owner like you in this current climate, a cash benefit plan can lead to great tax savings too.

Tax Saving Benefits

Cash balance plans have been growing in popularity due to their tax-reducing capabilities for businesses. Contributions to this plan are tax-deductible for you as a sponsoring employer. For instance, if you fall into a 35% federal tax bracket, a $100,000 cash balance contribution could lead to tax savings worth $35,000. Tax benefits can increase if you are living in a US state with income tax laws. Let’s look at this with an example.

The Hypothetical Case of the XYZ Corporation

You are one of the owners of a law firm XYZ corporation. At age 58, you and your partner are trial attorneys, without any employees. You take home approximately $275,000 annual income. After being in this business for 20 years, you intend to retire in 4 years. In 2021, you settled a lawsuit and received a onetime payment of $625,000.

Now, normally, you will have to deal with the taxes for this one-time huge payment along with your annual incomes too. But, using a cash balance plan can help create a lump sum liability of approximately $740,000 when you retire at 62. This will result in a maximum deductible contribution of up to $636,000. At a rate of 5% annual return, the $625,000 will amount to $797,675 approximately.

Is the Plan Right for You?

So, the question is whether the cash balance plan is right for you. It could be:

- If you and your partner wish to increase retirement savings significantly

- You generate steady income

- The existing defined contribution plan limits your saving potential

- You and your partner have an annual income more than $250,000

- You have fewer than 15 employees

With that being said, cash balance plans could be expensive for businesses with employees. While in a typical 401(k) plan, your contributions would be 3% to 6%, here overall costs could increase in range of 5% to 8%.

This could be a great time to plan for 2022, as we stand at the crossroads of a probable change in corporate tax rate. Consult a cash balance consultant today to know your options.

No Comments